When the time is right, we help owners sell from a position of strength on their terms. We start by understanding your unique objectives—timing, ideal post-close role, and other priorities—and design and execute an optimal competitive process to achieve them, balancing price, fit, and certainty of close.

Sell-side M&A: Maximizing price, fit, and certainty

What we do

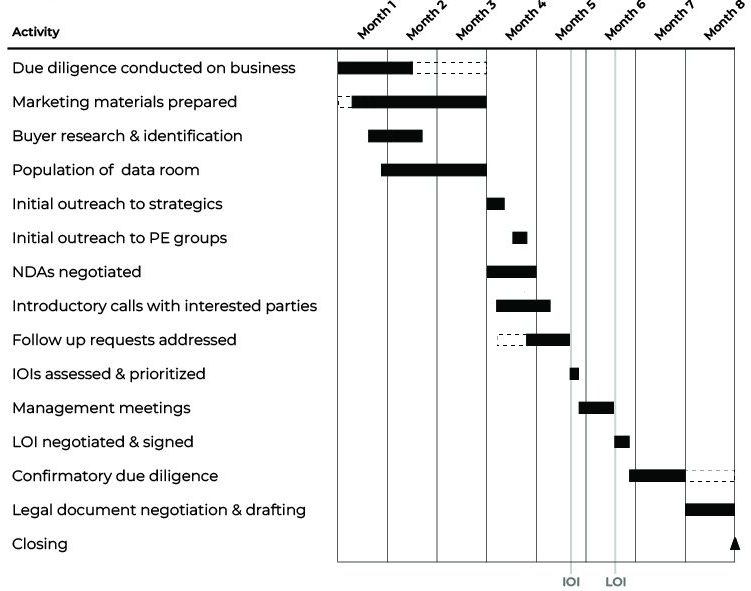

We begin by running our own due diligence to identify and resolve gaps, normalize financials, and proactively frame the narrative. McCombie Group actively covers thousands of private equity and strategic buyers; together, we select a curated set of qualified buyers aligned to your goals. From outreach to final closing, we proactively manage all of the details—driving a disciplined process that increases value and the likelihood of a successful transaction. This enables you to fully focus on leading your organization during this critical period.

The human side

Your business isn’t just a number– it’s your legacy. Selling is a deeply personal and emotional journey. We pair execution with coaching: Guiding you through high-stakes decisions, communication with various stakeholders, and maintaining perspective under pressure. Success means personal satisfaction as well as the financial outcome. Our standard: advise as if it were our own family’s business.

World-class senior expertise

Your process is led by senior bankers, supported by transactional accounting and analytics under one roof—so we know the numbers cold and negotiate the fine print with precision. Unlike most advisors, we’ve led PE investments ourselves and know what buyers want. We are proud to have been recognized for setting record valuations and have been finalists for various Deal of the Year awards.

Ready to explore options? Let’s map the path that maximizes value, fit, and certainty for you.